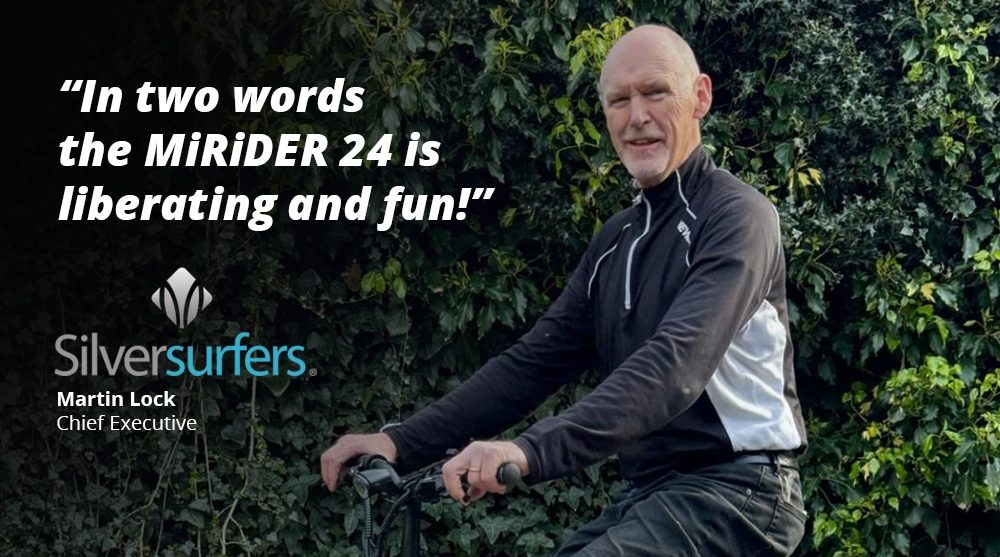

OUR CYCLE TO WORK SCHEMES

SAVE UP TO 42%* ON A MIRIDER EBIKE, ACCESSORIES AND SAFETY EQUIPMENT

For commuting to work, getting fitter or leisure riding it has never been more cost effective to get a MiRiDER ebike with a government backed cycle scheme.

You can spread the cost of the bike, accessories and safety equipment over 12-18 months. You pay by way of small interest FREE monthly payments from your salary before tax.

Most cycle scheme providers work in a similar way but ask your employer which scheme they offer and then read about the process below.

Cycle Schemes

How does it work?

Cycle2work is a government initiative which offers the most cost-effective way to get new cycling equipment. If your employer has joined Cycle2Work, you won’t have to pay tax or national insurance on these items – saving you up to 47%! The reduced cost is simply deducted from your payslip over 12 or 18 months.

You can even access promotional and seasonal offers such as Christmas and Black Friday, on top of Cycle2Work savings!

Find more information here.

How to Apply

-

Employer code

If your employer has a live scheme, you’ll either be given an employer code to sign up directly through Cycle2Work, or be pointed towards your benefits portal to apply.

-

Choose your value

Choose your bike and/or accessories online at Halfords or Tredz (including those on sale or promotion) or from one of 100s of independent retailers before applying, so you know the total value to apply for.

-

Sign up

Now that you have your employer code and total value, you’re ready to apply.

-

Approval

Once your employer has approved your application, you’ll receive a ‘letter of collection’.

How to buy

-

Use your ‘letter of collection’

You can purchase your bikes and accessories directly through us by emailing your Letter of Collection to hello@mirider.co.uk. Alternatively, you can use our store locator to find participating retailers in your area.

-

Pay monthly

Once your scheme starts, the salary sacrifice will be deducted out of your payslip over 12 or 18 months.

-

End of scheme/Ownership

At the end of your agreement, we’ll get in touch to discuss what you want to do next. This will include the option to enter a zero-cost ‘extended hire’ arrangement. With this option, the items will remain in your possession until HMRC deem the value to be negligible. Once the happens, you’ll automatically become the rightful owner!

Save up to 42% on the cost of bikes and equipment.

Improve general health and well-being.

Lose weight and get fitter.

Steady rate interest-free payments.

Save money on daily travel costs.

Help the environment by reducing toxic car fumes.

Get Involved / Sign Up Steps

Register with Bike2Work using the form. You’ll get a company PIN number from your employer.

Choose your new bike or equipment from one of our partner stores, after which you will be given a written quotation.

Sign into Bike2Work and submit your quote.

We will then send an invoice and hire agreement to your Employer, which must be signed by both Employer and Employee.

Your company will make payment to us and we’ll send a voucher for your new bike or equipment.

Take your voucher to your chosen shop and collect your new bike or equipment.

WHAT IS CYCLESCHEME?

Cyclescheme allows you to pay for a new bike using a ‘salary sacrifice’ employee benefit. You choose a bike, hire it for an agreed length of time, and then snap it up for a fraction of its original value. All while making huge savings (at least 25%!) and spreading the cost.

There is no longer a £1000 limit, meaning that (depending upon your employer) you can choose a new MiRiDER One bike.

PLEASE CLICK HERE TO VISIT THE CYCLESCHEME WEBSITE FOR ALL THE RELEVANT DETAILS

HOW TO ORDER A BIKE USING THE CYCLESCHEME VOUCHER

- First you’ll need to find out if your employer is already signed up to the Cyclescheme. If they are you’ll need their ‘company code‘ (please speak to your HR department). If not, they can apply online here – LINK.

- Choose the bike and any accessories you would like to be included in the scheme.

- Once you have the ‘company code’, you can apply for an e-certificate on the Cyclescheme website – LINK.

- If successful you will be emailed an e-certificate with a redemption code on it.

- Next email your e-certificate along with the bike and accessories, your delivery address and contact number to hello@mirider.co.uk. Ensure the total value of the order matches that on the e-certificate.

- We will redeem the e-certificate and once payment has been received from Cyclescheme, your bike will be dispatched. This can take a couple of days to process and we will email you to confirm successful redemption and a subsequent dispatch date.

BENEFIT OVERVIEW

The scheme enables an employee to get a new bicycle and/or safety equipment and pay for it through their salary sacrifice, typically saving them between 32% and 45% off the cost (depending on their personal rate of tax).

Traditionally, Cycle to Work schemes have been operated through one retailer or online shop. With the My Benefits World scheme employees can choose to use a range of local retailers or nationwide high-street chains.

HOW IS IT PAID FOR ?

The company buys the bicycle and the employee repays your business through Salary Sacrifice over a period of 12-24 months (most employers opt for 12 or 18 months). The employer, can set a limit on how much employees can spend on a bicycle/accessories.

A free extension to the hire agreement offers the best deal for employees at the end of the repayment period. The employee then has the option to own the equipment at the end of the term when the transfer of ownership (Fair Market Value Payment) is £0.

If the employee leaves the company prior to the end of the repayment period (the period when your business has recovered the cost of the bicycle from salary), any remaining money owed is collected from their final salary payment.

The cycle to work scheme with no £1,000 limit

WHAT IS GREEN COMMUTE INITIATIVE?

Green Commute Initiative is a Social Enterprise with a vision to get commuters out of cars and onto any kind of bike, with the dual purpose of improving both the individual’s health and wellbeing, as well as reducing the environmental impact of pollution and congestion from cars. We do this through our cycle to work scheme.

ABOUT THE sCHEME

Your employer buys a voucher which entitles you to the hire of a bike of your choice directly from us. Because we’re authorised by the FCA there is no £1,000 limit.

The cost of the voucher is the same as the bike so for a £1,500 bike the voucher is £1,500.

You repay the cost of the voucher by sacrificing a part of your gross (before tax & NI) salary. This means you save the tax and NI that you would pay if you bought the bike from your net (after tax) pay. Your employer also saves 13.8% employer’s NI. So it’s worth them doing it.

At the end of the hire period we can’t give you the bike because you would incur a tax liability. So, we make you a free of charge loan of the bike for a further five years and nine months. After 6 years, under a separate agreement, we can transfer to ownership title to you for a £1 processing fee. The £1 acts as a marker to protect you from any future claim that HMRC may make.

We manage all the end of scheme arrangements so there is nothing for your employer to do and best of all no end of scheme sting as there is on old fashioned Cycle to Work schemes.

Cycle to work schemes allows employers to offer their employees the use of a bike for commuting in exchange for a salary sacrifice. The salary sacrifice enables the employees to use their gross pay to reimburse the employer for the cost of the bike. The gross pay is before tax, so the employee saves the tax and national insurance which would have been due on the amount sacrificed (32%, 42% or 47%). It also allows employees to spread the cost over monthly pay packets, making the acquisition more affordable.

Yes. You can see the confirmation in the third paragraph on the Employment Income Manual page of their website.

“The exemption also covers the provision of a voucher for hiring bicycles and equipment.”

One of the big four accountancy firms said:

“Our review of the GCI documentation has confirmed that the scheme arrangements are

robust and comply with the relevant legislative exemption in respect of cycles and cyclist’s

safety equipment.”

Please ask us if you would like to see a copy of their report.

There are two separate agreements:

The salary sacrifice agreement is between the employer and employee and covers the repayment of the voucher cost. This can be for any period longer than twelve months that both parties are happy with. Common terms are 12, 18, 24 months but it could be for as long as 60 months.

The hire agreement is between the employee and GCI Ltd. This is unaffected by the length of the salary sacrifice.

Green Commute Initiative is authorised by the Financial Conduct Authority for consumer hire up to any value. Since you’re hiring the bike from GCI, your employer doesn’t need FCA approval. View our FCA registration

This all depends on which income tax-band you are in. This coupled with your national insurance contributions will give you the percentage of what you’ll save from your gross salary.

Example

Basic Taxpayer Rate = 20%.

National Insurance contributions = 12%.

Total saving = 32%

Higher rate tax payers can save as much as 47%.

To find out how much you will save on your bike package, use our savings calculator.

Finance taken out with a third party is between the employer and the finance company and as such, the employer will repay the loan. The employer recoups the money from reduced salary payments, minus the commission on the loan. The cost of the loan is more than covered by the employer’s reduced National Insurance payments. The employer still saves money.

Akira can time their payments so they are due after the salary payment date.

more

When an employee leaves before the end of the agreement, any outstanding amount on the loan must be repaid within 14 days of leaving the employment. However, the final salary payment must not take them below the minimum wage. If the outstanding amount owed is not fully covered by the final salary payment, the employee must pay it through their own means. This will mean that they lose the tax free benefit on any amount not paid via their salary.

If you pay PAYE as a Director you will qualify. You may wish to consult your accountant for advice.

Sadly, you will not be able to take part because your tax arrangements are different. You may be able to claim business use for the bike though.

Yes, reducing your gross salary will most likely reduce your pension contributions, which in turn affects your final pension pot. However, your employer might have different pension arrangements in place. Please consult your pension provider for more details.

The bike shop may wish to charge a deposit in order to secure the deal, however they should refund this back to you in the event your organisation decides to not take part in the scheme. If you do proceed, the deposit will be refunded back to you when you collect your bike. However, if the bike shop has had to place a special order for you, they may decide to withhold the deposit in the event the deal does not go through. You should ensure both you and the shop are clear on this point.

Your organisation does not need to be signed up for you to use Instant GCI. Instant GCI works on an individual basis, so as long as your employer agrees to your request, you can go ahead. If they have already allowed other individuals to take part in the scheme, it is likely that the scheme will be advertised internally on either staff noticeboards or the intranet.

For Corporate GCI, your organisation will have an GCI code which allows you to access the dedicated portal. Your HR department or intranet will provide this.

Where a salary sacrifice arrangement is used, your gross pay is affected, which in turn impacts upon your tax and National Insurance Contributions (NICs). As entitlement to some benefits is based on the amount of NICs that are paid and others on earnings, entering into a salary sacrifice arrangement may affect your current or future entitlement to a range of benefits.

The cycle to work scheme with no £1,000 limit

WHAT IS VIVUP?

We encourage cleaner, greener journeys to and from work by providing your people with savings of up to 43%* on the latest bikes, high-vis clothing and safety equipment from the leading cycle brands 2

How to pay with a Vivup Cycle to Work Voucher

With Vivup you need to start by getting a quote for the bike that you want. You can do this by sending an email to Hello@Mirider.co.uk Enter your quote onto the Vivup website so that your employer can approve it.

When your quote has been approved Vivup will issue you with a purchase order. This will list the exact bike you want. Just bring that back to us with your ID and we can release your bike to you. If you are getting the bike delivered then just email the purchase order to us.

The Vivup process involves getting a quote first. So we will normally check the stock and reserve a bike for you fairly early on. That way you can collect it as soon as you have your voucher.

The cycle to work scheme with no £1,000 limit

How does the cycle to work scheme work?

The employee can choose their own cycle and safety equipment

The employer buys the equipment and hires it back to the employee who then repays their employer over 12 months

No credit checks are required on the employee or employer

All the information required for payroll is provided by the team at Enjoy Benefits

All end of hire scheme options are also managed by EB taking the pressure off of the employer to ensure compliance with HMRC guidance

Companies save Employers NI so for every £1,000 the company spends on bikes, it saves £138 in NI

You can get fitter, more productive and healthier

Find out more infomation here

GOGETA

Get the best tax-free deals, with no retailer surcharges. Gogeta saves you money by paying for your new bike out of your gross pay.

Why are we different

- Flexi-voucher – Unlike other cycle schemes who issue a voucher that you must redeem in full from one store, on one day, ours is flexible. So you can spend it as many times as you want, in different stores, until the balance runs out.

- Never any surcharges – Because we charge the lowest commissions to retailers out of any cycle to work provider, they pass on the best deals to you and will never charge a surcharge for using Gogeta Bike.

- No hidden fees at the end – By using the cycle to work scheme, you’re effectively hiring your bike over a set period of time before it becomes officially yours. To transfer ownership to you at the end we have to charge something (HMRC says so) but unlike other schemes who charge up to 10% of the value of your bike, we keep this as low as we possibly can – just £1. Don’t worry, this sounds complicated but it really isn’t. You can read more about it in our FAQs.

How does it work?

So, you earn £ gross income per year. And you want to buy a £ bike.

Usually, you’d buy that with your net income, or take home pay, after you’ve paid tax and national insurance.

With Gogeta, you make that same £ purchase before you’ve paid income tax and NI, with your gross salary. This simple change means your purchase actually only costs you £ and so you save £ on your bike.

You also get to pay the cost of your bike back over 12 months interest-free via salary sacrifice. Pretty good, right?

To run the cycle to work scheme, Gogeta charges a fee, which is added to the amount you salary sacrifice. When you apply for your Gogeta Bike voucher, you’ll get a full breakdown of the savings, the fee and the amount you’ll salary sacrifice every month. All the savings shown in our calculators are inclusive of our fee, so the savings shown are the real savings you will experience.

Calculator can be found here